Buffett's bet on Apple

- Pokey

- May 9, 2018

- 1 min read

What can we expect from Apple moving forward? The products are awesome. The ecosystem is addicting and at the moment impenetrable. Tim Cook is a Dukie and Industrial Engineer. Which is inspiring me to get a graduate degree in Industrial Engineering and fulfill my childhood passion, shoutout Mike Massimino, the author of Spaceman.

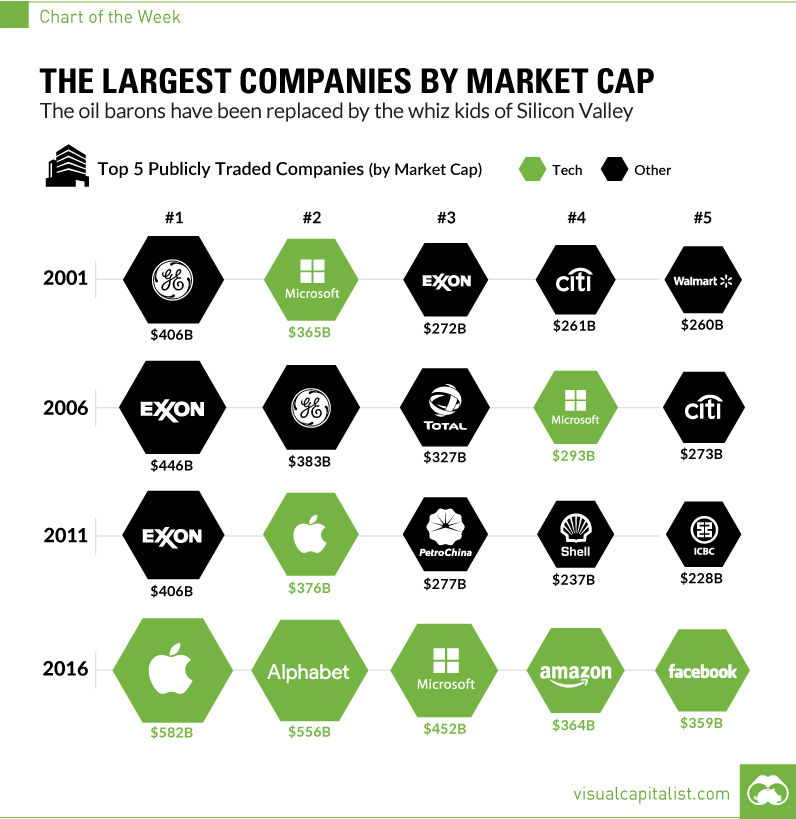

My concern is what history has shown us about the largest companies in the USA.

Apple has already been at the top for 7 years. Which appears to be longer than most timespans.

Bill Gates advices that technology stocks should have low PE's because of the ever-changing landscape.

As technology has dominated the world it's apparent that Warren Buffett missed these companies. The moat is real for these tech companies and reason I'm willing to pay a higher PE not just for Gates' standards, but the average US company.

I want to know why Buffett has stuck with $KO. Coke hasn't grown at all from 1998-2018 and to this day is still one of Buffett's top holdings. I hope with my investment strategy I ride the winners like Warren rode $KO, but then feed other investments once a company stalls.

So I question $AAPL as an long term investment. At the moment it looks very attractive. A ton of cash. Low PE.

However, history tells me to avoid betting big on the biggest company in the United States. Especially since, I don't have the capital of Buffett and can move the needle on < $1B investments.

Comments